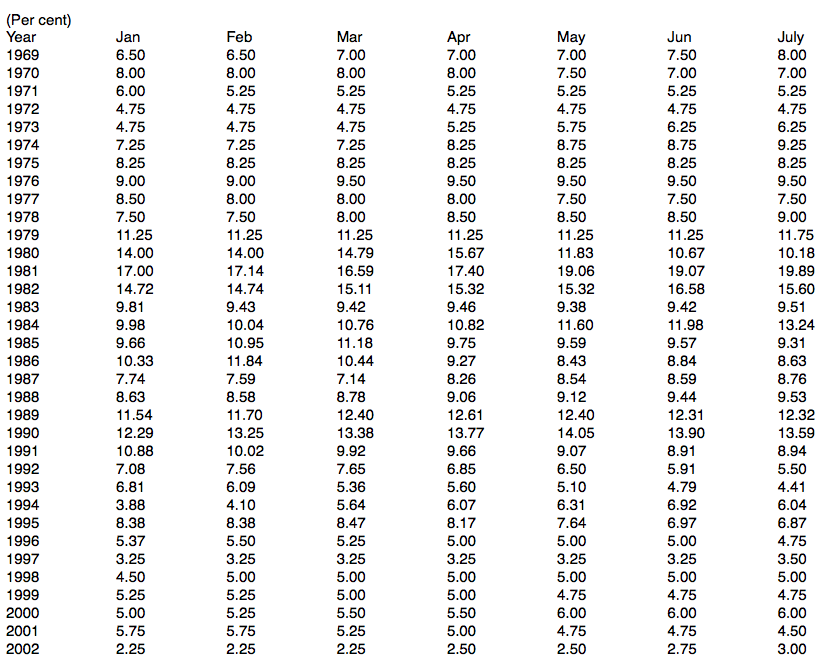

For example, in January 2015 the central bank of Canada decided to cut interest rates by .25 % and again in June another .25% at a time when the U.S. dollar vs Canadian dollar was close to par. The results were dramatic to say the least. Gas prices rose significantly and food prices followed as the Canadian dollar began to drop against the US dollar. What was an exchange rate of 1.05 (CAD to USD) in November of 2014, quickly rose by the fall of 2015 to 1.49. In my opinion, this is a classic method in which governments quietly transfer wealth from citizens to government via inflation. Below is a gold chart illustrating golds performance in Canadian dollars. Note the high in 2011 just under $1900 and golds 92.96% return over the last 10 years. You can see a direct correlation between gold’s rise and the decline of the Canadian dollar in 2015 right after the Bank of Canada cut rates in January 2015 and the $200 correction in 2017 when they did a complete reversal and began to hike rates. Recently, there was a spike in gold after the central bankers switched yet again and decided to pause and not hike rates further. This is exactly the type of random and unstable environment gold insulates its investors from. In the second chart above we see the Canadian dollar currently trading below the post 2008 financial collapse and trending lower. This type of steady decline over time will force the Bank of Canada to react aggressively to prevent further loss of confidence. Canadians have not seen this type of aggressive hiking since the early 1980’s which was the last time confidence in the Canadian dollar was questioned. Below is a history of Canada’s overnight lending rate from 1969 – 2002. Dates of Note:

BANK RATE Source: Bank of Canada, Data and Statistics Office. Once you’ve taken the time to put these historical interest rates into perspective you’ll see that the trend after 1991 has been to use lower interest rates to “stimulate growth” lulling Canadians into the belief that rates will remain low indefinitely. Sadly, this irresponsible monetary policy has created a massive burden of household debt and over inflated home prices which in my opinion will sharply correct sooner rather than later. Fiat currency only has value when it’s backed by confidence, once lost, its worthless. So what can you do to protect yourself?

With International Gold Vault Ltd., you can buy and sell physical gold, silver, platinum and palladium in one ounce increments with 0% commission. All accounts are insured to full market value by Lloyds of London. Bullion is delivered to private depositories upon purchase and can be transferred internationally upon request.

Contact us directly at 833.221.4555 or email info@internationalgoldvault.com for more information. Written by Rob McInerneyWww

1 Comment

Kelly

2/1/2018 12:52:48 pm

More then what Rob has created with his new company for me is trust and integrity . I have a wife and five kids so my money is their money and listening to Rob has served us well. Trust is hard to earn especially in today’s markets and Rob has earned our trust.

Reply

Leave a Reply. |

AuthorNews & Updates are written by myself or when shared from the industry, credit is always given to writer. Rob Archives

January 2022

Categories |

RSS Feed

RSS Feed